After a bust period of flat or declining revenues, U.S. textbook publishers are expecting a boom in the sales of K-12 instructional materials and assessment products over the next several years, according to a prominent Wall Street analyst.

The rosier outlook comes thanks to the slate of upcoming state textbook adoptions, improved forecasts for state spending on education, and the provisions under the federal No Child Left Behind Act that call for research-based instruction and annual testing of students.

“We think that after three years of lackluster growth, the boom is back in the K-12 educational publishing market,” says the report released last week by the New York City-based investment firm Goldman Sachs. Publishers of K-12 products could see the market grow 7 percent or more over the next four years, compared with virtually no sales growth from 2002 to 2004, according to “Making the Grade in 2005,” written by Peter P. Appert, the firm’s publishing-industry analyst.

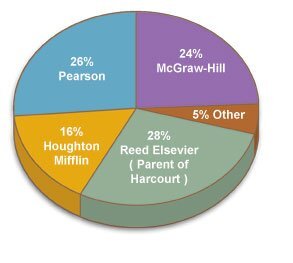

The 70-page report was presented to investors and industry representatives as part of a private conference on educational publishing in New York last week. The Goldman Sachs report estimates that publishers will have revenues of $4.7 billion from K-12 instructional materials in the United States in 2005, up from $4.3 billion last year. The report indicates that the four largest publishers now control 95 percent of the U.S. market for K-12 educational publishing.

The conference, which was closed to the press, also featured presentations from representatives of the largest education publishers, as well as budget analysts, all of whom agreed with the optimistic outlook for the industry, according to several attendees.

“We feel the market is vibrant,” Margery Mayer, the president of the education division of Scholastic Inc., the New York City-based publisher of children’s books and school materials, said in an interview. “Everyone agreed that No Child Left Behind has been good for business.”

Textbook publishers were far less optimistic at their annual conference a year ago, when Mr. Appert predicted the industry would experience its worst period in terms of revenue growth in more than a decade. The calculation was based on a lull in the cycle of state textbook adoptions and decisions by some states to delay big purchases until the economy improved. (“State Budgets Put Fear Into Text Publishers,” Feb. 25, 2004.)

The 2003-04 school year ended a little better than predicted—with the industry showing no growth instead of a decline—owing to the availability of federal money under the Reading First program for buying commercial reading products and professional-development services, said Stephen D. Driesler, the executive director of the Washington-based school division of the Association of American Publishers.

The improvement of the adoption cycle “over the next three years in particular, and the continued demographic growth in the K-12 population,” he said, “continue to increase the need for the number of instructional materials.”

Growth for Tests, Too

During the current school year, California, Texas, and Florida are all slated to select books in key subjects and allocate hundreds of millions of dollars to enable districts to buy them. Those states are the largest of the 21 so-called adoption states, which designate which texts can be purchased with state money. The three states spend, on average, a combined $1 billion on instructional-materials purchases annually.

Publishers’ Pie

SOURCE: Goldman Sachs

While the 2005-06 school year may bring another brief dip in revenues for publishers, the following school year is expected to yield big sales in mathematics programs, according to Mr. Appert’s analysis. And, in the 2007-08 year, the big three adoption states are scheduled to select reading/language arts texts, the most lucrative subject area for school publishers.

The testing requirements of the 3-year-old No Child Left Behind law is driving unprecedented growth in the test-publishing sector as well, according to John Oswald, who oversees the elementary and secondary education division of the Educational Testing Service, of Princeton, N.J. Mr. Oswald participated in a panel discussion at the conference on the assessment market.

“Everyone knows that under NCLB, the state assessment business is growing like crazy,” Mr. Oswald said in an interview. “That’s now causing school districts and the states to say we need to get high-quality classroom-based diagnostic tests and formative assessments [to monitor students’ progress throughout the school year]. That market as a result is booming, and everybody is looking to fill it.”

The Goldman Sachs report projects that the U.S market for K-12 testing materials will exceed $1 billion in 2005, and will continue to grow through 2007, when states will be required by the federal law to add a science test in grades 3-8, in addition to the math and reading exams that are mandated beginning in 2005-06.