President Donald Trump’s unprecedented decision to impose tariffs on goods imported from most countries could lead to higher prices for schools on everything from paper and lumber to laptops and tablets. The stock market declines sparked by the tariffs could hurt retirement plan funds that educators rely on. And the levies could trigger an economic recession with devastating fiscal consequences for school districts and the broader public, economists say.

But Trump’s disorienting rollout and rapidly shifting policy priorities have even the sharpest economists puzzled about the extent of the short- and long-term fallout—leaving school district leaders with yet another layer of uncertainty on top of an already-turbulent budget season.

Even the 90-day pause Trump announced April 9 for many of the steepest tariffs is offering little comfort.

“I don’t know what to count on, what not to count on,” said Cheryl Jordan, superintendent of the 10,400-student Milpitas district in northern California. “I’m just taking the most conservative course, which is the tariffs are going to be there, … so we need to be prepared and plan for the worst-case scenario regardless.”

A wide range of goods schools need—classroom supplies, textbooks, vehicles, technology tools, food, and more—could come with higher prices if the Trump tariffs stick around. That’s on top of price increases in recent years caused by inflation.

The Evanston, Ill., school district reported this week that its furniture vendors have announced a 25 percent cost increase to take effect at the end of the month, on top of a 5 or 6 percent year-over-year increase the district was already contending with, the Evanston Roundtable reported. Another Illinois district shrunk its order of projectors from 100 to 75 this week after hearing that the vendor planned to raise prices due to tariffs, EdWeek MarketBrief reported.

Jordan’s district has the third phase of a construction project in the works. The team is looking to start purchasing some of the materials now, “even before the ground is broken, just to be able to protect us against rising prices of materials,” she said.

It’s unclear whether those price increases will hold if Trump keeps changing his approach to tariffs. But if construction costs continue to spike significantly, some districts could see projects exceed the costs of bonds their voters had approved or their initial project budgets.

There has been plenty of change since Trump’s initial tariffs announcement

After months of teasing and years of theorizing about the potential for tariffs to revive American manufacturing, Trump on April 2 announced steep tariffs on nearly every nation, including 34 percent on China, 20 percent on the European Union, and 46 percent on Vietnam. The announcement sent the U.S. stock and bond markets into a tailspin.

Since then, Trump has claimed—without listing them—that 75 countries have reached out with the intention to negotiate new trade agreements. He walked back most of the steeper tariffs on April 9, but has twice ratcheted China’s tariff upward since then.

As of April 11, Trump has raised the tariff on goods from China to 145 percent, maintained a 25 percent tariff on many goods from Canada and Mexico, and imposed a 10 percent tariff on goods from most other countries.

He has declared a national trade emergency and invoked 1970s-era laws to assert the authority to impose tariffs without approval from Congress. So far, lawmakers haven’t moved aggressively to walk back Trump’s tariff power, even as some—including fellow Republicans—have grumbled about the economic disruptions and presidential overreach.

School districts are already experiencing the fallout from tariffs

Ripple effects from tariffs Trump imposed earlier this year on Canada, China, and Mexico had already begun playing out before the current round of tariffs took hold.

The Pender County school district in North Carolina, for instance, had to spend more than school board members had hoped to purchase 2,000 urgently needed laptops in mid-March after two companies cited tariff uncertainty and waffled on pricing, Port City Daily reported.

Rick Gay, executive director of business services for the 80,000-student Fort Bend school district in Texas, has worked on purchasing in school districts for three decades. Some district leaders have contacted him in recent weeks asking how to respond to a technology vendor seeking permission to raise prices and citing tariffs as the justification—in some cases, even before Trump finalized his long-teased tariff plans.

“I have cautioned people to push back very hard on any requests for price increases,” Gay said.

He sees parallels to the early days of the pandemic, when companies were raising prices as supply-chain disruptions piled up. But for some products, the ripple effects from tariffs may not cause tangible changes in the supply chain for months.

And in some cases, the imposition of tariffs shouldn’t affect manufacturers’ or distributors’ costs at all. Texas, for instance, requires schools to buy local food when possible. Food that isn’t imported from other countries shouldn’t be affected by tariffs, Gay said.

Gay advises district leaders to insist that companies demonstrate specific reasons why their costs are higher and prices need to go up accordingly. Contracts with vendors should contain strong language that prevents companies from raising prices except in the event of “acts of God” like hurricanes, he said.

He also typically includes in contracts a cap on the amount the vendor can increase the cost—"either the [Consumer Price Index] or 3 percent, whichever is lower.”

Vendors’ “inability to figure out the market doesn’t mean that it increases my cost to do business,” Gay said.

Tariffs would have wide-reaching affects beyond imported goods

Schools wouldn’t just face higher costs if tariffs persist. State revenue for schools could take a hit if the economy sinks into a prolonged recession.

The two main sources of state revenue for schools would both be at risk, experts told Education Week. Income tax collections would droop as wages stagnate and unemployment rises. Consumers would then have less money to spend on goods, depressing sales tax revenue as well.

Pension funds—already underfunded by billions of dollars—would be more likely to fall short of actuarial projections, leaving states to either pay bigger chunks of retirement obligations themselves, or defer those costs to local districts.

Alabama’s public pension investments, for instance, lost $1 billion in one day when Trump first announced the new tariffs, when the stock market plummeted to its lowest levels since the pandemic began.

“When you dump over the apple cart, it’s totally expected to have major ramifications,” said David Bronner, CEO of the state pension system, in a statement that day.

The nation’s top 25 pension funds for state and local employees—most of which include school district workers—lost a combined $169 billion between April 3 and 8, according to an issue brief published April 9 by the Equable Institute, a nonprofit pension research firm.

Meanwhile, collective bargaining agreements between schools and their employee unions that mandate annual salary increases could limit the wiggle room schools would have to trim budgets if they unexpectedly have less funding, said Jonathan Travers, president and managing partner of consulting at Education Resource Strategies, a firm that helps school districts with finance issues.

“You just locked yourself in, so now you only have so much agency. You’ve got to figure out how to pay for that,” Travers said.

Depending on the scale of a recession, some districts could be forced to reopen those agreements, prompting tense negotiations with crucial staff groups.

To some extent, school district leaders have no choice but to be prepared for volatile times like these because of the nature of their operations, said Joshua Hyman, an associate professor of economics at Amherst College who studies education finance.

“Unlike many firms or businesses, they can’t control their own prices, they can’t generate revenue. There’s only so much you can make from a big bake sale,” Hyman said. “They’re at the whim of these economic forces.”

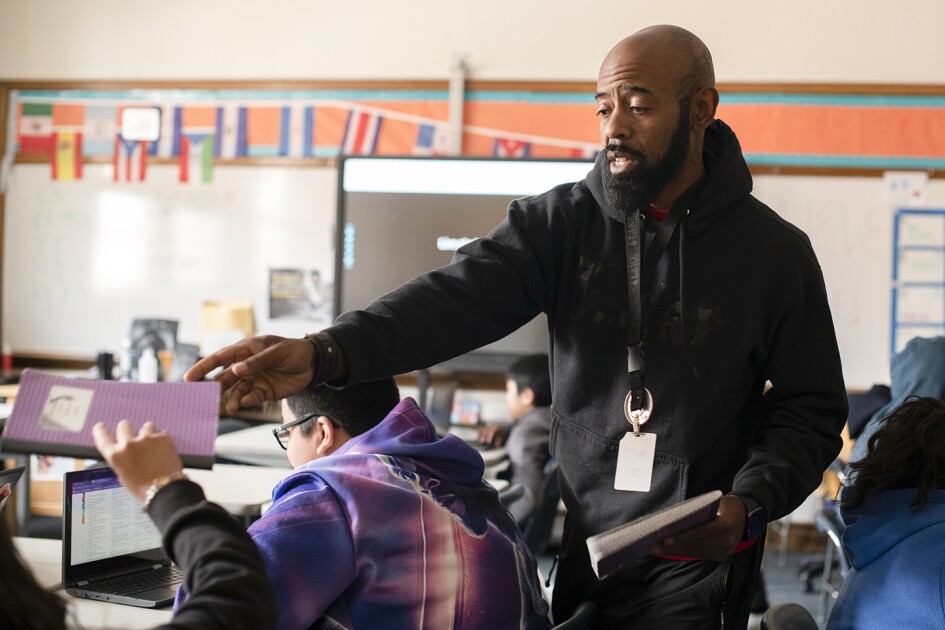

Even in the absence of an economic downturn so far, the rapidly changing financial environment has infused fresh uncertainty into the mix, adding to the stress of districts and their staff, which trickles down to the classroom, said Jordan, the superintendent in California.

“When teachers are feeling anxious about the future, they might not have as much patience as they would normally, they may be less energized to create really dynamic lessons, and it greatly depletes their sense of value,” Jordan said. “It’s becoming very difficult for teachers overall, and tariffs just add to that whole sense of uncertainty.”